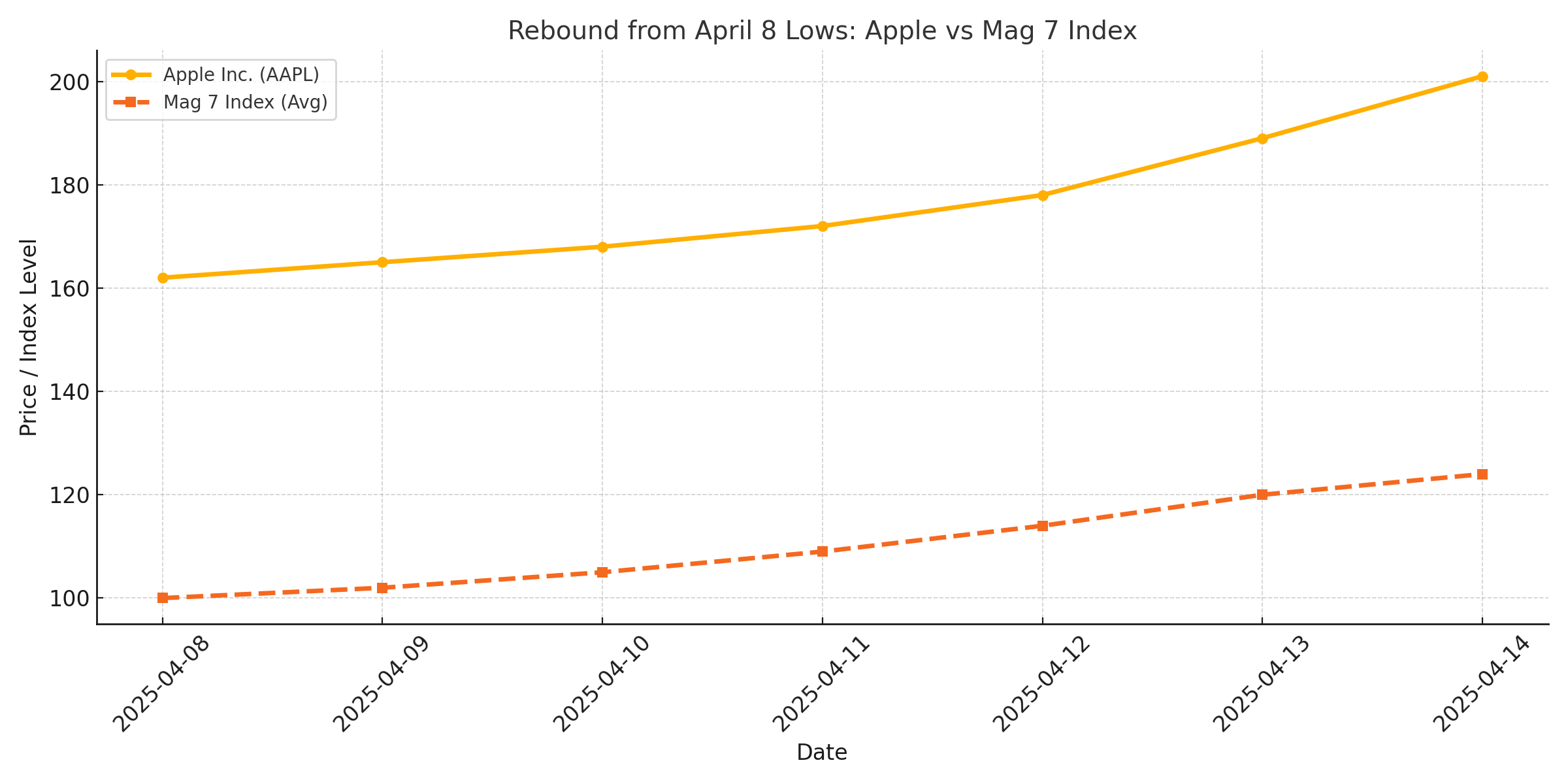

Let’s not dance around this. Apple is up 6.25% today alone after Trump announced a specific exemption for the company on Saturday — that’s not a rumour, that’s a straight-up policy edge. Since the low on April 8th, the stock has rallied 24%. That’s a $700B+ market cap bounce in a week, for those keeping score.

And yet… no one’s calling it a bottom.

The Real Question: Was This the Bottom, or Just a 90-Day Reprieve?

We’ve seen this movie before. Political heat ramps up, markets wobble, then bang — a “surprise” announcement gives big tech a shot of adrenaline. Feels coordinated? Maybe. Feels like backroom exemptions for friends or favourites? Could be. But whether it’s insider trading or just narrative control, the tape doesn’t lie.

Truth Social posts, followed by sector-specific exemptions, and then the best single-day Mag 7 performance since the Q4 2022 CPI fake out? Come on. That’s not coincidence. That’s event-driven narrative flow — and as Shiller reminds us in Narrative Economics, these stories move markets more than fundamentals in the short run.

Is This a “Buy the Mag 7 or Get Left Behind” Moment?

If you’re sitting on the side lines watching NVDA, MSFT, AAPL, GOOGL, META, AMZN, and TSLA tear away, you need to ask yourself:

If you’re not buying now… what are you doing?

This kind of capitulation bottom setup doesn’t come around often. How often? Try every 3–4 years, on average. And from these lows, the median 2-year return for mega-cap tech has historically ranged from 45% to 120%, depending on the catalyst and liquidity backdrop.

Do we know for sure this is the low? No. But here’s what we do know:

The VIX got nuked post-announcement. Complacency is back.

The options skew flipped bullish — calls are getting bid.

Apple just printed a 24% rebound in under 7 sessions. That’s not mean reversion — that’s institutional size pressing the gas.

What This Might Really Be: The Trump Rally, But in Stealth Mode

Trump’s not backing down publicly — but this move smells like a silent climbdown. Instead of broad de-escalation, he’s pulling strings sector by sector, company by company. That creates winners (AAPL) and laggards (everyone else), but it also sends a signal to the street:

“The heat is off — at least for now. Rotate back into risk.”

If this is a 90-day political window leading into an election-fuelled melt-up, you want to be in early, not chasing the 12th green day.

Final Take

Apple’s move isn’t just a bounce — it’s a signal. It’s either:

The start of a structural regime shift (Trump’s second coming, with fiscal/industrial favouritism baked in), or

A temporary sugar high that gives traders a shot to lean into beta before we fade back to reality.

Either way, if you’re not building exposure to the Mag 7 here, you’re not just underweight — you’re out of position.

So ask yourself:

Is this your moment to reload risk, or are you still waiting for the perfect bottom that never announces itself?

Because Apple just told you: sometimes, the bottom rings a bell.

If you’re looking for a FREE, trading course, chatroom access & a complementary 1-on-1 to get you started, click here & use discount code FREE, today!

Happy investing!